The Family Handyman: Automotive

There has been lot of debate in digital and social media about the pros and cons of old versus new tax regime after the proposed changes in direct taxes in 2023 Budget. Many people are arguing that below the income slab of Rs 15 lakhs or more, the tax rates for different income tax slabs are lower in the new regime; therefore, the new tax regime better for incomes below Rs 15 lakhs.

The big headline is that in the New Tax Regime, you do not have to pay any tax for income up to Rs 7 lakhs. On the other hand, you can avail of various deductions in the old tax regime which are not available in the new tax regime. So which tax regime is better? There is no straightforward answer. It depends on how much deductions you can claim.

Impact of the changes in the New Tax Regime (Budget 2023)

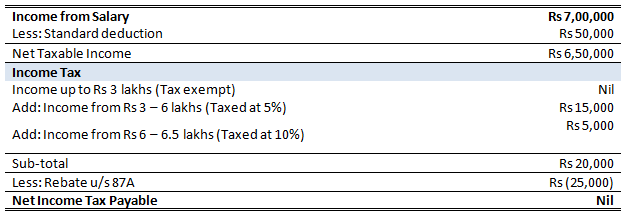

Let us first discuss the changes made in this year’s Budget. The Government has increased the basic exemption limit in new tax regime from Rs 2.5 lakh to Rs 3 lakhs. Standard deduction of Rs 50,000 will now be available to new tax regime also. The rebate available under Section 87A has been increased from Rs 12,500 to Rs 25,000 for taxable income up to Rs 7 lakhs in the new tax regime. The table below shows the impact of changes in new tax regime for an individual / HUF with income of Rs 7 lakhs.

Deductions available in the Old Tax Regime

Apart from the standard deduction of Rs 50,000 which is now available to both tax regimes, there are several deductions available in the old tax regime, which tax payers cannot avail in the new tax regime. Some the common deductions claimed by tax payers in the old tax regime are:-

- Section 80C (PPF, ELSS, Life insurance etc): Rs 1.5 lakhs

- Section 80 CCD (1B) (National Pension Scheme): Rs 50,000

- Section 80D (Mediclaim): Rs 25,000 (for self) + Rs 50,000 (for senior citizen parents)= Rs 75,000

- HRA (House rent allowance): Lesser of (a) Actual rent paid or (b) 50% of basic salary + DA (for metro cities) or 40% of basic salary + DA (for metro cities)

- LTA (Leave travel allowance): Will depend on the maximum LTA provided by your employer and your actual cost of travel by air (economy class only), train (up to First AC fare) or bus.

- Section 24 (home loan interest): Rs 2 lakhs

Tax payers should know that these deductions are available only in the old tax regime. However, whether you can claim these deductions or not, and also how much deduction you can claim, depends on your personal financial situation. Next we will show several scenarios of deductions that can be claimed under old tax regime, taxes payable thereof and how it compares with taxes payable in new tax regime.

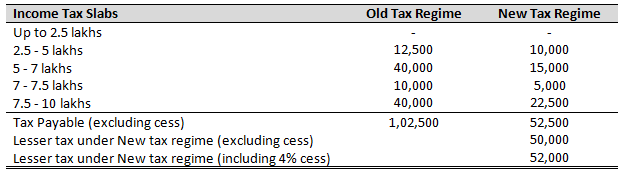

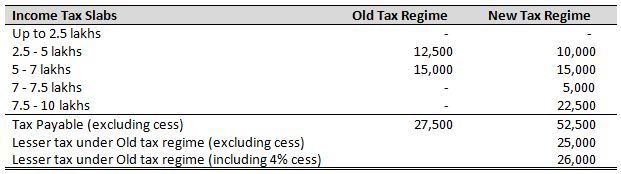

Scenario 1 – No deductions are claimed

Let us assume your gross taxable income is Rs 10 lakhs and you are not claiming any deduction, other than the standard deduction. Let us see what will be your tax payable in the two regimes. Clearly the new tax regime will be more tax efficient if you are unable to claim deductions.

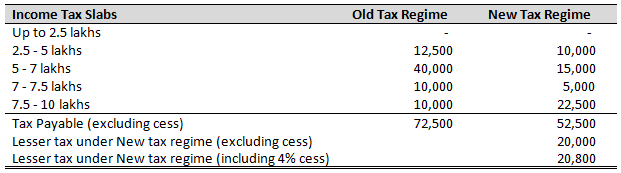

Scenario 2 – You claim deductions for Section 80C

Let us now assume that you are able to claim Rs 150,000 deduction for investments made in 80C schemes like ELSS, PPF or life insurance policies. The net taxable income including standard deduction and 80C deduction will now be Rs 8 lakhs. Let us see what will be your tax payable in the two regimes. You will still be better off in the new tax regime, as far as net tax outgo is concerned.

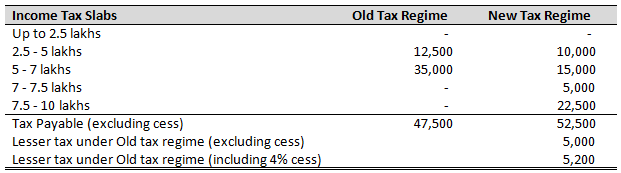

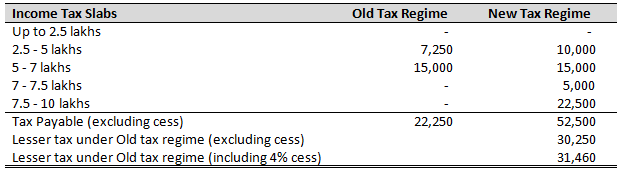

Scenario 3 – You claim deductions for Section 80C, 80 CCD (1B) and 80D (self / family and parents)

Let us now assume that you are able to claim Rs 150,000 deduction for investments made in 80C (e.g. ELSS, PPF or life insurance policies etc), Rs 50,000 for NPS and Rs 75,000 for Mediclaim purchase for self / family and senior citizen parents. Your taxable income reduces by Rs 3.25 lakhs. Your taxable income after deductions is Rs 6.75 lakhs. Let us see what will be your tax payable in the two regimes. Now the situation has changed. You will pay lesser taxes under the old tax regime.

Scenario 4 – You claim deductions for Section 80C, 80 CCD (1B), 80D and Section 24

Let us now assume that you are able to claim Rs 1,50,000 deduction for investments made in 80C (e.g. ELSS, PPF or life insurance policies etc), Rs 50,000 for NPS, Rs 75,000 for Mediclaim purchase self / family and senior citizen parents and Rs 1,00,000 for interest on home loan interest (Section 24). Your taxable income after deductions is Rs 5.75 lakhs. Let us see what will be your tax payable in the two regimes. You pay even lesser taxes under the old tax regime.

Scenario 5 – You claim deductions for Section 80C, 80 CCD (1B), 80D, Section 24 and HRA

Continuing with the above example, now suppose that you are currently living in a rented house and you are paying monthly rent of Rs 15,000. Your taxable income after all deductions is Rs 3.95 lakhs. Let us see what will be your tax payable in the two regimes. You pay even lesser taxes under the old tax regime.

Taxes should not be the only consideration

Investors are often persuaded by tax considerations in making financial decisions. But taxes should not be the only consideration. You should also consider your financial goals and needs in making investment decisions. Tax saving investments under Section 80C instill financial discipline and a culture of savings, which can help you meet your long term financial goals. Your financial goals are of utmost importance and the tax saving is an added incentive. You should consider all factors and make informed investment decisions.

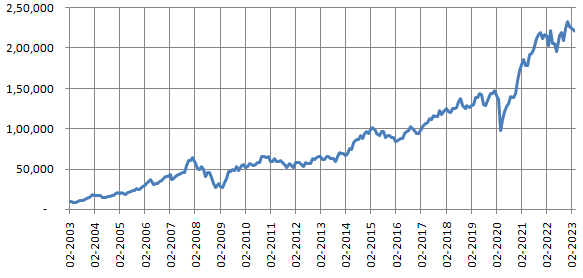

ELSS has the potential to create long term wealth

Equity linked savings schemes are diversified equity mutual funds with a 3 year lock in period. Equity as an asset class has the highest wealth creation potential over long term investment horizons. The chart below shows the growth of Rs 10,000 investment in Nifty 50 TRI over the last 20 years.

Source: National Stock Exchange, Advisorkhoj Research. Period: 1st February 2003 to 31st January 2023. Disclaimer: Past performance may or may not be sustained in the future.

Conclusion

The problem with certain notions in social media, particularly as it relates to investment and finance is that the notions are based on certain assumptions which may or may not reflect your own financial situation or needs. In this article, we have shown that there are scenarios where old tax regime is more beneficial and vice versa. You should consider your financial situation, consult with your tax advisor and make informed investment decisions keeping your long term financial goals in mind.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.